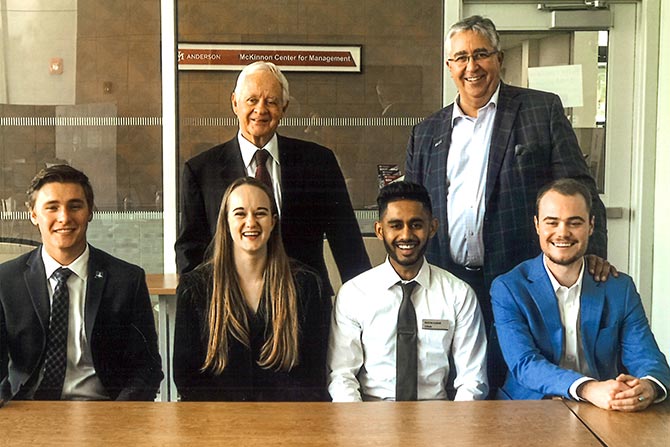

Pictured above: John Anderson and Dennis Garcia with the 2019 group of NMBA interns.

Since 2018, the NMBA, with the assistance of University of New Mexico’s Anderson School of Management, has undertaken an annual internship program, allowing college graduates to get a foot in the door in the banking industry, supplying them with valuable experience and allowing prospective employers a chance to work with potential employees in a hands-on setting. The success of internship programs tends to be determined in the planning and implementation stages, allowing such programs to function smoothly once put into practice. This article will examine the elements of a successful internship program, both from the NMBA’s perspective and from a more holistic perspective.

In setting up an internship program in its early stages, it is crucial to have a specific vision and concrete goals that your bank wants to achieve with the program. Setting up an internship program to have participants do grunt work may fulfill the immediate needs of a company, but oftentimes doesn’t lead to the long-term success of the program. Obviously, every bank is going to have its own specific needs, but, generally speaking, giving interns reasonably challenging tasks and goals can lead to a much more fruitful program in the long run and will attract the best candidates possible. From both our research and our own experience, I will explore some general rules that can vastly improve your company’s internship program.

Establish an Intern Program Coordinator

It’s crucial to have someone in charge of building the program, to both guide it forward and to coordinate planning and implementation. Without someone in charge, there is a risk that the program will be rudderless and lack long-term planning. This position doesn’t need to be a separate full-time position, but can be taken on by someone within your organization. Often, individuals working within an organization can both coordinate the program and impart wisdom, knowledge and advice to the interns.

Albuquerque Banker and NMBA Board Member Liz Earls, Capra Bank, has done much of the work of program coordinator for the NMBA, and her expertise and enthusiasm has been invaluable. Liz has both the knowledge and passion for the program to make her an ideal leader for it. Since 2018, we’ve had the chance to work with numerous dynamic young professionals, with several participants getting hired at financial institutions in the state. Ultimately, you want to find intelligent, capable interns who can use the program as a springboard for their professional career, and Liz has helped us mold our program into that.

We would be remiss if we did also note the importance that Suzanne Mirabal of First National 1870, Trevor Lewis of Capra Bank and retired bankers Dennis Garcia, Silver Browne and Paul DiPaola have also meant to the early success of the program.

Set Goals for Your Interns and Stay in Touch

It’s important to set goals for your interns and track their progress throughout the period of the internship. Setting up one or two major projects can both be beneficial to your bank and provide interns a preview for what they will be working on in the future. It also provides participants in the program with a sense of purpose, and avoids the pitfall of having an aimless internship program. If an intern is able to complete a significant project during his or her time in the program, then that person is more likely to feel compelled to work for your bank. Prospective employees respond to being given projects that test their knowledge and skill, and an internship program is a perfect way to lay the groundwork.

It is also beneficial that the intern be encouraged to engage with as many members of the bank staff as possible, not just those employees that are in the department or division that the intern is assigned. This will provide the intern a better understanding of the environmental and job potential within the bank itself. To that end, the more people who know you and your skill set, the more likely you are to find employment.

According to a report by the National Association of Colleges and Employers (NACE), about 70% of interns receive a job offer from the company they’re placed with. Nearly 80% of those receiving a job offer accept it, which translates into 56% of interns going on to become full-time employees. Further, interns are likely to stay long-term with a company that’s helped cultivate their skills. After one year, 71% of interns remain employed by the company, and after five years, nearly 44% are still on staff. Also, when interns work on substantive projects and feel like they are making a contribution, they are more likely to want to stay with the company.

It’s also important to maintain at least a tenuous connection or casual contact with your former interns. It provides your bank with proactive networking and the opportunity to reconnect in the future, possibly for employment opportunities. A good internship program can be a training ground for young talent, so staying in touch often proves mutually beneficial. Your bank can choose whether to pick interns who are college graduates or still in school, which depends on an organization’s particular needs.

Distribute Information About Your Program

It’s also important to distribute information about your program ahead of time. No matter how great an internship program, it can’t thrive if no one knows about it. We begin recruiting several months before we want the internship to start, particularly if you’re looking for someone to start at the end of the school year. Many students begin making plans as early as possible. A few tips for drawing attention to your internship program:

- Post the internship on job boards.

- Send information to career centers at local colleges and universities.

- Ask specific departments or faculty to distribute information to students or post on their bulletin boards.

- Add the job posting to your website.

The NMBA’s internship program has been assisted tremendously by its alliance with University of New Mexico’s Anderson School of Management. It has given us access to a plethora of terrific candidates and has given our program far more exposure.

John Anderson with the 2024 group of NMBA interns.

Should Interns Be Paid?

According to the Fair Labor Standards Act, you can only bring on unpaid interns in certain situations. In these cases, the internship has to be primarily educational and benefit the intern more than the company. Nearly 61% of internships are paid, according to the NACE report, with an average wage of $19.05 per hour. Most unpaid internships are in the social services sector. Besides meeting legal requirements, you’re more likely to attract talented and motivated candidates by compensating your interns. And you’re far more likely to attract interns to seek full-time employment in the future if you compensate them. The NMBA program provides compensation for our interns, which is paid by the participating bank.

There’s no set way to structure an internship program, you have to tailor it to meet your bank’s individual needs. But there are general rules that will allow your organization to attract highly qualified candidates. Providing interns with challenges and actual work situations will prepare them better and work in your bank’s favor.

By having someone coordinate the program and creating alliances outside your organization, you can quickly get your program off the ground. For the NMBA, Liz Earls’ participation and our relationship with the Anderson School has been essential to our program’s success thus far. It has allowed us to set a vision for the program and begin to implement it.