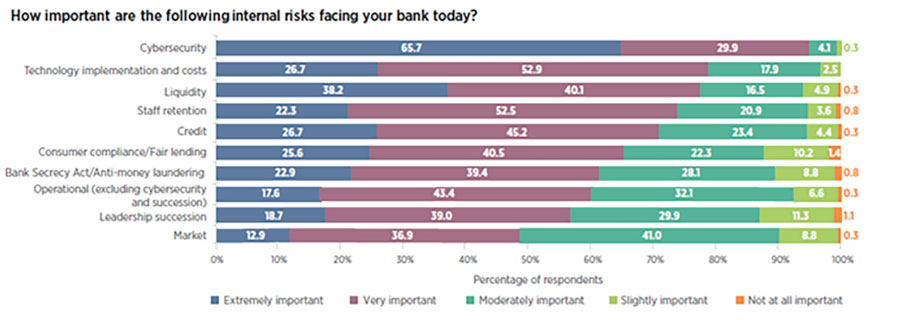

Retaining talent is one of the greatest challenges banks face in today’s dynamic workforce. In fact, staff retention is among the highest concerns, as noted in the 2024 Annual Survey of Community Banks, conducted by the Conference of State Bank Supervisors (see Figure 1). With employees spanning multiple generations — from baby boomers to Gen Z — a one-size-fits-all approach to compensation no longer suffices. Each generation brings unique perspectives and expectations to the workplace, making it crucial for banks to develop tailored compensation strategies that incentivize retention across all age groups.

For example, as baby boomers (born 1946-1964) approach retirement or work post-retirement, many Boomers seek stability with generous retirement benefits and health insurance. Gen X (born 1965-1980) values competitive salaries, work-life balance and retirement contributions. Millennials (born 1981-1996) and Gen Z (born 1997-2012) place a strong emphasis on meaningful work, transparent compensation, growth opportunities and short- to mid-term bonuses to help pay for other pre-retirement financial goals such as purchasing a home or funding a child’s education.

Compensation is one of the most important drivers of success in recruiting key talent, particularly in a tight labor market. Comprehensive compensation plans that are successful in landing key talent include not only an attractive base and performance bonus plan but also tailored mid- to longer-term incentives, non-qualified benefit plans and other executive benefits.

Employers increasingly recognize and understand the link between well-designed executive compensation packages and overall organizational performance.

Creating effective strategies for attracting and retaining key employees across multiple generations can be the game-changer that ensures your most valuable and strategic employees stay and thrive within your bank. It requires structuring compensation packages with flexible options in order to address varying generational priorities. The following are three strategies that your bank can implement to retain and reward top talent.

- SERPs

According to the American Bankers Association’s 2024 Compensation and Benefits Survey, nearly 67% of banks report utilizing deferred compensation plans for key positions.2 These plans can include supplemental executive retirement plans (SERPs), providing a defined post-retirement benefit. SERPs are widely popular with baby boomers and Gen X. Unlike similar broad-based qualified plans, a SERP has no contribution limit or rules that mandate that all employees must be able to participate. They are purposely designed for highly compensated executives and key employees for whom the 401(k) contribution limits act as a form of “reverse discrimination” toward retirement. Also, SERPs are generally fully funded by the bank. - Strategic Deferred Compensation Plans

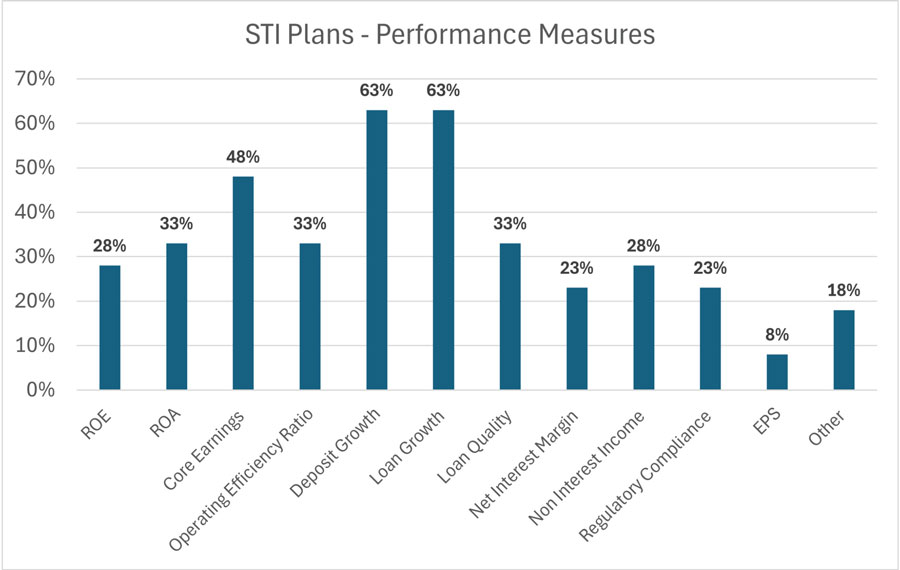

These are used when a bank wants to create both a recruiting and retention incentive for top talent. A strategic and customizable deferred compensation plan (DCP) is fully funded by the bank. These are defined contribution plans, with contributions often based on performance criteria designed to support bank strategic goals. These programs are not usually “all or nothing” in nature. In other words, there is a range of contribution levels tied to performance levels, including no contributions in down years. Strategic DCPs can allow for contributions and earnings to be credited to balances based on ROA, ROE or another metric, thereby tying the long-term value of contributions to the performance of the bank. See examples in the following chart.

If Institution Performance or Department/Functional Performance are considered, are the following specific performance measures used for short-term or annual incentive plans?

2024 National Compensation Survey Report

A deferred compensation plan often includes a vesting schedule for bank contributions designed to incentivize participants to remain employed in order to fully benefit from the plan. This serves as a mechanism to not only align your top performers with the goals of the bank but also retain those top performers. For younger generations, a popular feature is one that allows for in-service distributions. “In-service” DCP payment schedules are customizable and can be made at any point (e.g., three, five or 10 years) or even to coincide with certain life events. These can include a home purchase, student loan repayments or a child entering college.

- Phantom Stock/Stock Appreciation Rights Plans

Long-term incentive plans can be an important part of an officer’s compensation package. However, while many privately owned banks are reluctant to share actual tangible equity with their employees, some have been more open to a strategy that is tied to the appreciation of the bank’s value over time.Phantom stock and SARs are ways to provide an equity-like benefit to employees without having them own actual stock. These plans can be designed to pay key officers bonus compensation tied to an increase in the bank’s stock or book value. In a SAR plan, the bank determines a hypothetical stock price through an internal or external valuation of the bank. Officers are awarded some number of hypothetical or “phantom” shares that include specific terms and conditions. At a pre-determined time, the officer receives a cash payment equal to the difference between the original price and the appreciated price.

For example, let’s assume the officer receives 1,000 phantom shares with a beginning price of $50. At the end of three years, the bank calculates the phantom stock price to be $75 and then pays the officer any positive difference; in this example, the bank would pay the participant $25,000.

The Bottom Line

This article highlights the importance of banks reviewing current programs and, where necessary, implementing new benefit plans that address the evolving needs of today’s multi-generational workforce. Based on NFP experience and research, we know that comprehensive benefits packages are key to providing the financial incentives needed to attract, retain and reward top talent and put both employers and employees on the path to success.

If your bank has previously implemented some type of non-qualified plan or retention plan, perhaps it’s time to re-evaluate the design and the related benefit agreements. Items to periodically assess include (1) compliance with IRC §409A, (2) revisions to benefit amounts given participant promotions and salary changes, and (3) accounting and tax considerations, including Change in Control (IRC §280G) provisions.

Whether your company has supplemental benefit plans in place or not, now is the time to take the next step toward securing your key employees’ financial well-being and your business’s future success. Don’t wait — invest in solutions that drive loyalty and growth today.

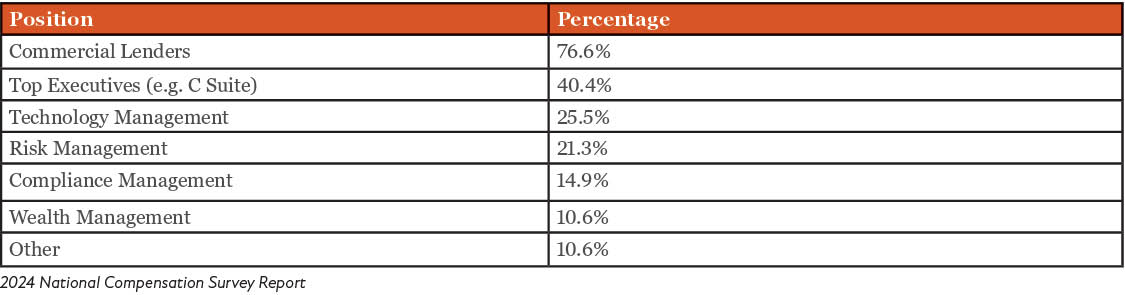

1 Source: 2024 National Compensation Survey Report, survey of banks was conducted by Pearl Meyer with data collected as of April 1, 2024

2 Source: 2024 Community Banks Compensation and Benefits Survey, survey of banks was conducted by ABA with data collected as of March 31, 2024

Ken Derks and Trey Deupree are consultants with NFP Executive Benefits. NFP is also a Premier Partner with the ABA. Derks and Deupree are registered representatives with Kestra Investment Services, Member FINRA/SIPC. NFP and Kestra Investment Services are not affiliated. To learn more, contact Ken Derks at ken.derks@nfp.com or Trey Deupree at trey.deupree@nfp.com.

View Investor Disclosures at www.kestrafinancial.com.