In the first half of 2020, the business outlook for many industries was uncertain. The abrupt decline in consumer demand caused many small business owners and corporate treasurers to seek the safety of increased liquidity and to pursue efficiency in cash flows. Since then, we have seen a dramatic change in business payment practices, prompting many community banks to reevaluate their current payment solutions and reconsider future investments.

First: Checks Decline

One of the initial and most dramatic changes has been the sharp decline in check writing. Some organizations had limited access to check stock, printing equipment, and adequate staffing to maintain the appropriate controls of the process. Stories abound of creative solutions implemented to ensure security in the issuance process and the physical safety of all involved personnel. Check volumes quickly declined and remain low. Business check writing is estimated to have dropped between 25-35% year-over-year at peak periods in 2020.

The next question naturally emerges: Is this a temporary situation or the realization of an accelerated digital migration for business payments?

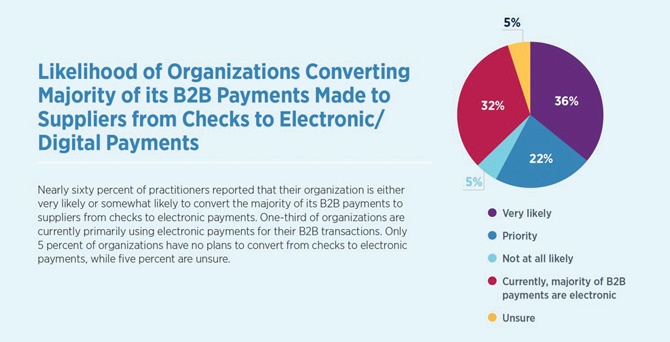

The Association for Financial Professionals (AFP), a trade group of corporate treasury and finance professionals, conducted an online survey of its members in the fall of 2020. The survey sought to understand how organizations were planning to handle business-to-business (B2B) payments.

These results seem to validate the observed decline in check writing. One-third of responding AFP organizations claim to currently issue a majority of electronic B2B payments. Clearly, the movement to electronic payments is not a new trend, as the B2B migration first emerged in the 1990s. However, the evolution has been slow and incremental. Until recently.

The more important finding in this same survey is that nearly 60% of responding organizations are very likely to prioritize electronic B2B payments, which indicates we may be seeing only the tip of the iceberg. We may be in the midst of a digital migration of business payments, unlike any previous change we have seen in this user segment.

Second: Electronic Payments Surge

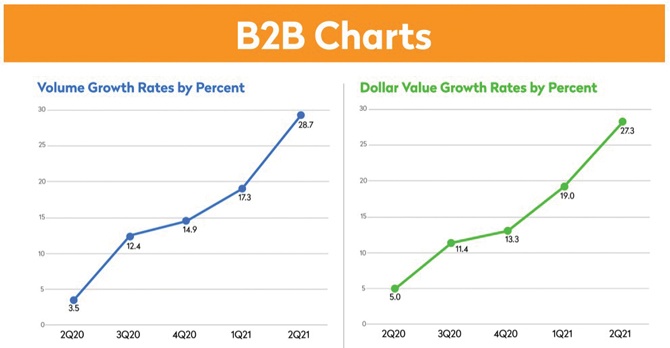

So, if checks are declining, what payment methods are being used for B2B payments? One clear benefactor is the ACH network. In the second quarter of 2020, B2B payments in the ACH grew in the low single digits. That volume quickly grew to double digits in the second half of 2020 and is approaching 30% year-over-year growth in 2021.

The ACH Network has long been an attractive alternative to checks because of lower processing costs and the inherent convenience of directly depositing funds to a bank account. Businesses are now seeing a related benefit in their internal processing. In the 2020 AFP Payments Survey, nearly half of the respondents claim that the straight-through processing of AP or AR and general ledger is the primary benefit of electronic B2B payments. The internal management and reconciliation of business proposals/RFP data, invoices, payments, and remittance details are challenges for businesses, and electronic payments provide significant efficiencies. Another benefit of electronic payments is the improvement to cash forecasting, which has been a critical corporate treasury element during our recent cycle of uncertainty.

Third: From Electronics to Faster Payments

The digital migration of B2B payments reflected in the recent ACH Network data may be part of a continuing migratory path. According to a survey by the Federal Reserve of over 2,000 businesses, 75% of companies consider the speed of money movement important and prefer faster payments.

For those businesses that have adopted the ACH Network for B2B payments, recent developments make the ACH an attractive faster payments option. A significant ACH change in 2016 facilitated money movement the same day. In March 2021, this was further enhanced and allowed financial institutions to send ACH transactions to the Fed as late as 2:45 p.m. Mountain Time (MT) for settlement at 4 p.m. MT. Many community banks are exploring Same Day ACH as a service option for business customers.

We expect the ACH changes implemented earlier this year, and the increased participation from banks across the Western U.S., will result in service innovation. Same Day ACH supports both debit and credit entries up to a maximum value of $100K per payment. The dollar threshold can accommodate 97% of all ACH B2B payments and a higher percentage of payments in other use cases. Nationwide, Nacha recognized 82% growth between 2Q 2021 and 2Q 2020, and nearly 149 million Same Day ACH transactions were processed in the quarter. This growth rate is double the growth rate in similar periods between 2020 and 2019.

Also emerging is a new category of “instant payments” that allows the transfer of good funds between financial institutions in a matter of seconds. The Clearing House implemented the Real-time Payments (RTP) network in late-2017 and now has over 150 banks participating. RTP facilitates 24x7x365 push credit payments that are irrevocable after submission.

In 2019, the Federal Reserve announced its intent to build a competitive solution to RTP, called FedNow. The FedNow service is slated for implementation in 2023 and will include many of the same characteristics of the RTP service. In fact, both the Fed and The Clearing House worked extensively to align the messaging standards and optimize compatibility of the two services. Both organizations realize that most U.S. financial institutions are not resourced to build multiple new payment services.

Both the FedNow and RTP solutions provide many of the benefits corporate finance professionals seek in their current operating environment and hold great potential for growth in the near term.

Next: Future Investments

When meeting with community bankers, I hear about the abundance of new opportunities and the challenges in determining where to commit the limited resources of time and money. These are never easy decisions but listening to our customers is typically a good start. Talk to your business clients and explore if their journey is similar to the one outlined here. Observed trends help to make those investment decisions easier and may support a client-centric ROI. n

William Schoch is President & CEO of Wespay, the nation’s oldest and one of the largest associations dedicated to helping members grow and improve their use of electronic payments. He is responsible for developing and implementing strategic initiatives to grow the association and provide maximum value to its 1000 members. He was appointed to this position in 2008.

In 2016, Bill was the incorporator of Wespay Advisors, a wholly-owned subsidiary of Wespay, which provides payments consulting and risk management services. He serves as a Director and the Secretary of the Wespay Advisors Board.

For more information, please call Bill at 415-373-1184, or email him at wschoch@wespay.org.