By William J. Schoch, President & CEO, WesPay

For most of my professional career, pundits have predicted the end of cash and checks. We entered this new decade with both forms of payment alive but in gradual decline. It appeared that we would see only the slow, very gradual death of both paper payment options. And then COVID happened.

More than eight months following the onset of COVID-19 in the United States, we see trends in consumer and business payment behaviors that help inform the current state of affairs and the future direction. Visa has reported debit card volumes in July and August 2020, 26% and 24% higher than the comparable 2019 periods. Nacha announced a 9% year over year increase in payment volume during 3Q 2020. While these electronic channels demonstrate growth, WesPay members tell me that check volumes are decreasing by double-digits. The Fed reported a 10.7% decline in commercial checks during the second quarter of this year. This is the largest percentage drop since 1994.

So how do you plan for the future of your bank’s customers? Electronic payment services and digital delivery channels are not going away and will likely increase in importance to end-users. Expanding these capabilities will enable banks to meet customers where they are today and prepare for future demands. One near-term opportunity holds significant potential for bankers and their customers located in the Western U.S.

Faster Direct Deposit and Direct Payment

The ACH network was first deployed more than 40 years ago and has been a workhorse for recurring disbursements, payroll, and bill payments by providing next-day transaction settlement. A significant change in 2016 facilitated money movement the same day. However, the early processing schedules favored financial institutions in the Eastern U.S. A number of us petitioned Nacha to approve processing schedules more favorable for financial institutions and their customers in the Mountain, Pacific, Alaska and Hawaii time zones.

Beginning March 2021, a new processing window will allow financial institutions to send ACH transactions to the Fed as late as 1:45 p.m. Pacific time (PT) for settlement at 3 p.m. PT. This empowers the ACH network for a new set of customer use cases:

- Direct Deposit for hourly, off-cycle, emergency payroll and termination pay

- Expedited bill payment for past-due or near-due obligations

- Business-to-business payments, such as tax payments and merchant funding for settlement

- Account-to-account transfers for moving funds between accounts at different banks

- Person-to-person payments for gifting and personal commitments

These enhancements to the ACH network enable banks to provide their customers with a range of new services. Businesses appreciate ACH payments because of the wide range of use cases that are supported, the lower cost of these payments, and the inherent security of the ACH network. Most businesses send and receive ACH payments today and have developed a high level of trust. Additionally, every financial institution in the U.S. participates, so there are no duplicate processes for in-network and out of network participants. Simplification of the process should not be underestimated for businesses of all sizes.

A 2019 survey conducted by the Center for Payments discovered that 75% of financial institutions in the U.S. offer Same-Day ACH services to business customers. An earlier survey of WesPay members showed that only half of the Western U.S. financial institutions were offering these services. We believe the initial early deadlines for submitting payments to the Federal Reserve and businesses’ inability to comply with these early cutoffs were the key reasons for lower participation rates in the Western U.S.

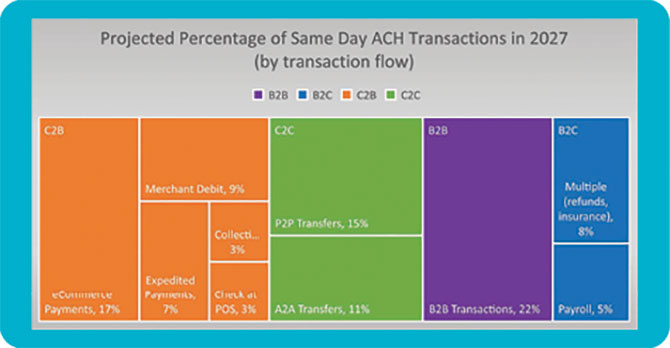

We expect the ACH changes in 2021 and participation from banks across the West will result in service innovation. Same-day ACH supports both debit and credit entries up to a maximum value of $100K per payment. The dollar threshold can accommodate 97% of all ACH business-to-business payments and a higher percentage of payments in other use cases. Nationwide, Nacha recognized 41% growth between 3Q 2020 and 3Q 2019 and nearly 94 million Same-Day ACH transactions were processed in the quarter.

This is a solution with outstanding potential for growth and customer engagement.

Follow the Trends

So why are faster payments important? Increasingly, consumers and small businesses are turning to non-bank service providers for fast and innovative payment services. A streamlined user experience, trust in the service provider, and surety in funds flow are critical components to a successful solution.

The emergence of non-bank payment solutions also provides a number of risks. It jeopardizes a bank’s relationship with its business customers and impacts its bottom line through lower balances and reduced fee income. Revenue diversification, especially non-interest income from business accounts, is critical in an extended low-interest-rate economy.

Bankers have no shortage of options when it comes to emerging payment solutions. Expansion of ACH origination services by using new same-day features provides upside potential and aligns with businesses’ and consumers’ trends.