The Small Business Boost (SBB) program from the Federal Home Loan Bank of Dallas (FHLB Dallas) offers member banks a lending tool to assist small businesses.

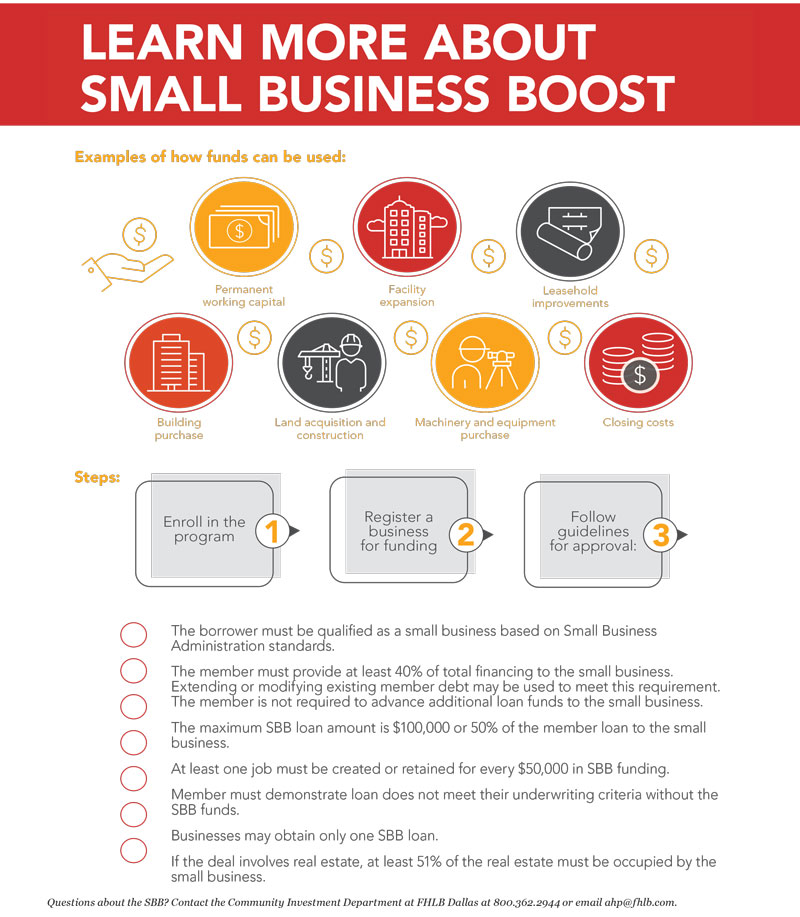

The low-cost, recoverable assistance program has no repayments due in the first year, helping to improve initial cash flow for the business. Funds can be used in several ways to start or expand a small business, including building purchases, land acquisitions, construction, equipment, working capital, and other related uses.

The program — offered through member financial institutions of FHLB Dallas — has assisted pharmacists, dentists, restaurants, gyms, automotive repair, and many other small businesses to form or help existing businesses retain or create jobs in their respective communities.

FHLB Dallas began offering SBB to its members in 2019 to provide a secondary, unsecured loan that fills a financial gap for a small business when there is a lack of equity or shortfall, making small business deals bankable.

As of Dec. 7, 2021, a total of 128 businesses have received $8,935,000 from the SBB lending program to support the creation or retention of 973 jobs. Funds for 2021 have been fully allocated.

A new round of $1.5 million in funding will be released in early January. Any funding left over from that round will be added to another $1.5 million in funds released in July. The exact dates for the funding release will be available soon at fhlb.com.